Here's a stat that should keep fintech founders up at night: 1 in 4 Indians can't survive a single month without income. And among those who can, 40% of their income goes toward EMIs.

We've built a consumer economy on leverage — home loans, car loans, personal loans, BNPL — without building a safety net for when things go wrong.

The Insurance Gap

India's insurance penetration tells the story:

- Life insurance: 3.7% of GDP

- General insurance: 0.9% of GDP

These numbers are low by global standards, but the real problem is deeper. Most insurance products in India are designed around death, hospitalization, and vehicle damage. They don't cover the most common financial shock: losing your income.

The EMI Trap

The average urban Indian professional has multiple active loans. When income stops — whether from job loss, health issues, or company downsizing — the EMIs don't stop. Within months, they're facing:

- Credit score destruction

- Penalty charges and compounding interest

- Asset seizure for secured loans

- Mental health deterioration

And this isn't just affecting lower-income groups. India's affluent middle class — the very people with the most EMIs — are the most exposed.

A Model That Works

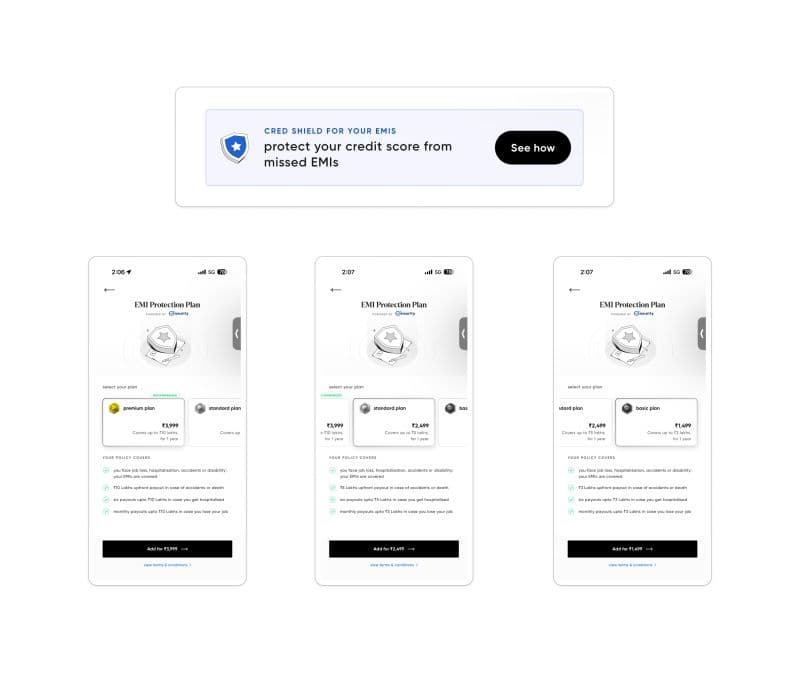

CRED's EMI Protection Plan is an interesting model. It covers your EMIs for a fixed period if you lose your job. It's simple, specific, and addresses a real pain point.

But we need more products like this. Insurance that maps to how people actually live:

- Income protection for gig workers and freelancers

- EMI shields that activate automatically on job loss

- Lifestyle insurance that covers the gap between your last paycheck and your next opportunity

- Family float plans that protect household income, not just individual lives

The Opportunity

The affluent underinsured represent a massive, underserved market. They have the means to pay for protection — they just don't have products that make sense for their lives.

Building these products requires understanding modern financial behavior: multiple income streams, variable expenses, lifestyle-dependent commitments. It requires reimagining insurance from first principles.

And that's exactly the kind of problem worth solving.