Only 5 crore Indians have personal retail health insurance. That's roughly 3% of our population. For a country of 1.4 billion people, this number should alarm everyone.

The Premium Allocation Problem

Here's what's happening with every ₹100 you pay as a health insurance premium:

- ₹50-60 actually goes toward your coverage

- ₹35-40 goes to operational expenses

- ~₹15 is lost to claims fraud

That's right — less than two-thirds of your premium is working for you. The rest is consumed by inefficiency and fraud.

Medical Inflation Is Outpacing Everything

Medical inflation in India runs at 12-14% annually. Compare that to general inflation at 5.2%. Healthcare costs are growing more than twice as fast as everything else in your life.

This means your health insurance premium needs to increase every year just to maintain the same level of coverage. And for most Indians, that makes health insurance feel increasingly unaffordable.

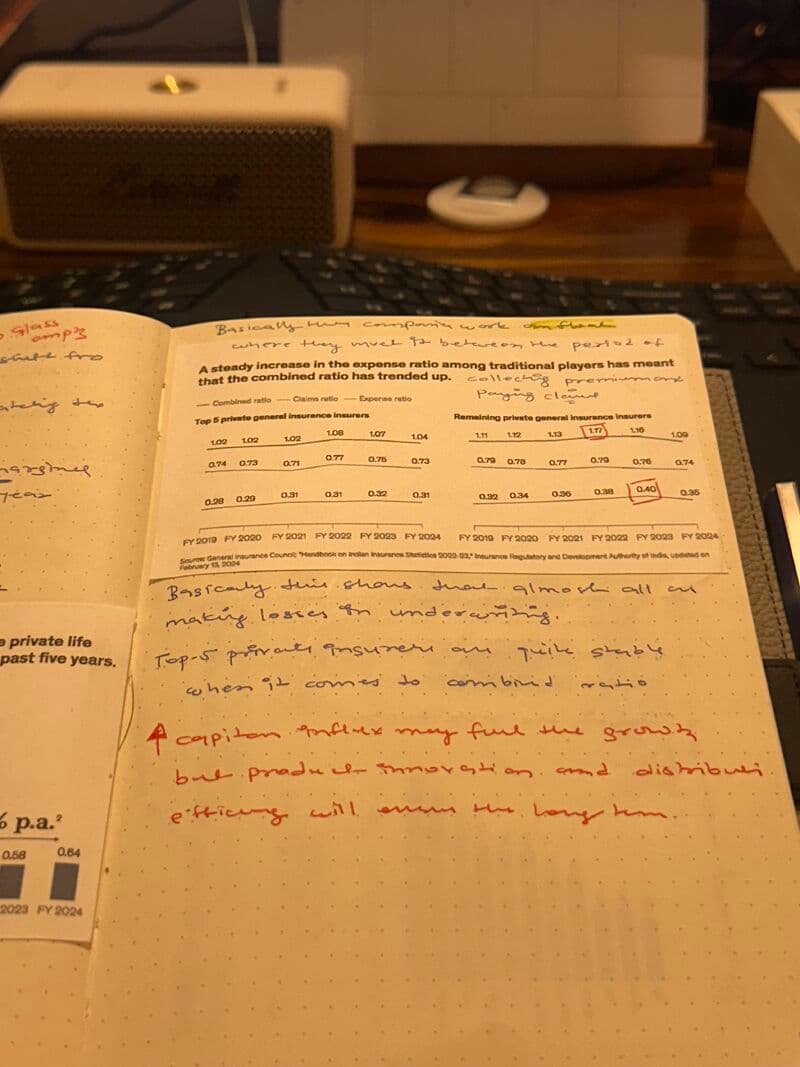

The Operational Cost Crisis

Insurance companies in India operate with expense ratios of 35-40%. This includes:

- Agent commissions and distribution costs

- Claims processing and manual underwriting

- Legacy IT systems and paper-based workflows

- Regulatory compliance overhead

Compare this to global best-in-class insurers who operate at 15-20% expense ratios. There's a massive efficiency gap.

Claims Fraud: The Silent Tax

Approximately 15% of all health insurance claims in India involve some form of fraud. This ranges from inflated bills to phantom procedures. Every fraudulent claim increases premiums for honest policyholders.

The B2B Insurtech Opportunity

The solution isn't just another consumer-facing insurance app. What we need are B2B insurtechs that can:

- Reduce distribution costs through digital-first channels

- Automate underwriting with AI and data analytics

- Detect fraud in real-time before claims are processed

- Streamline operations to bring expense ratios below 20%

If we can achieve this, we could potentially reduce premiums by 30-40% — making health insurance accessible to hundreds of millions of Indians who currently can't afford it.

The opportunity isn't just commercial. It's a chance to fundamentally fix how India's healthcare safety net works. And that's worth building for.